Solvency Assessment and Management: Steering Committee Position Paper 61 (v 5) SCR Standard Formula: Operational Risk

Solvency capital requirement and the claims development result | British Actuarial Journal | Cambridge Core

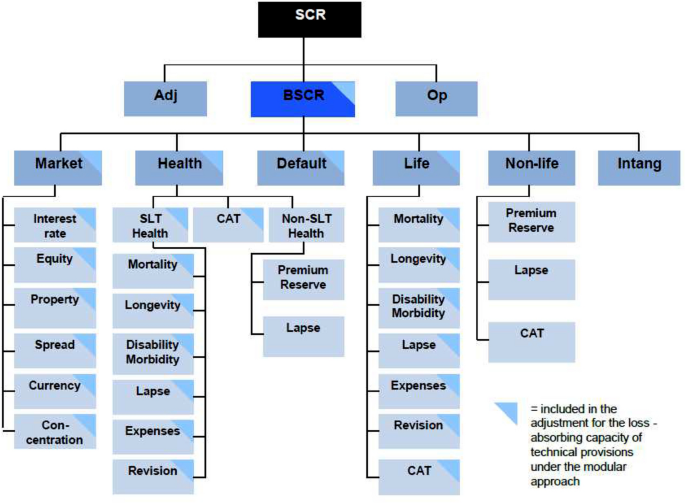

An Analysis of Solvency II Standard Formula for Calculation of SCR , possible corrections and a comparison with an internal model | Semantic Scholar

An Analysis of Solvency II Standard Formula for Calculation of SCR , possible corrections and a comparison with an internal model | Semantic Scholar

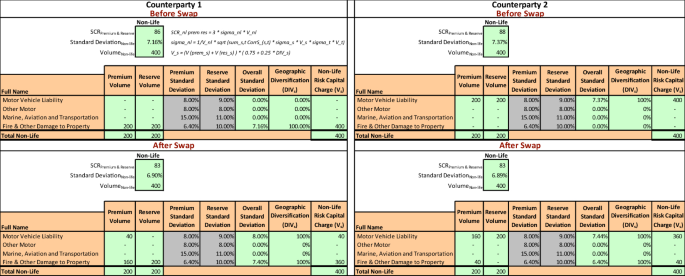

Diversification and Solvency II: the capital effect of portfolio swaps on non-life insurers | SpringerLink

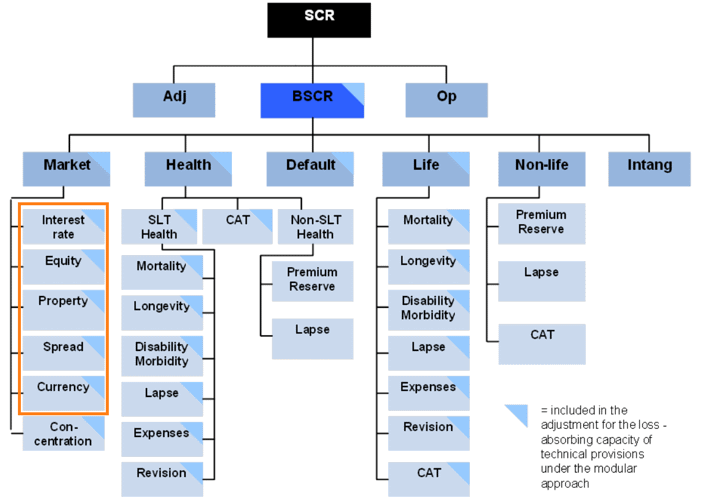

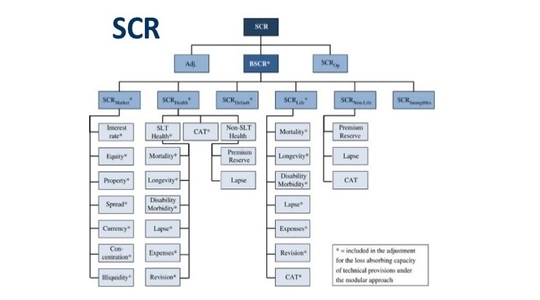

Solvency II in Europe and Internal Risk Modelling N. Savelli - Solvency II in Europe and Internal Risk Modelling N. Savelli - - ppt download

CEIOPS' Advice for Level 2 Implementing Measures on Solvency II: SCR standard formula - Article 111 (f) Operational Risk

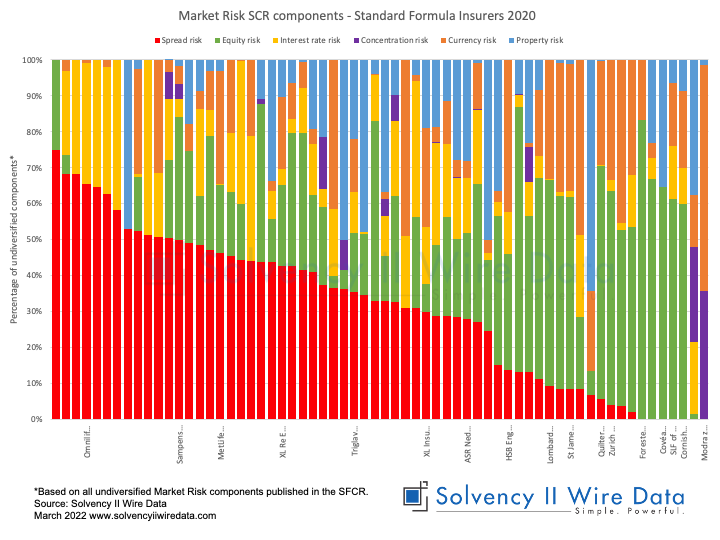

Measuring market and credit risk under Solvency II: evaluation of the standard technique versus internal models for stock and bond markets | SpringerLink

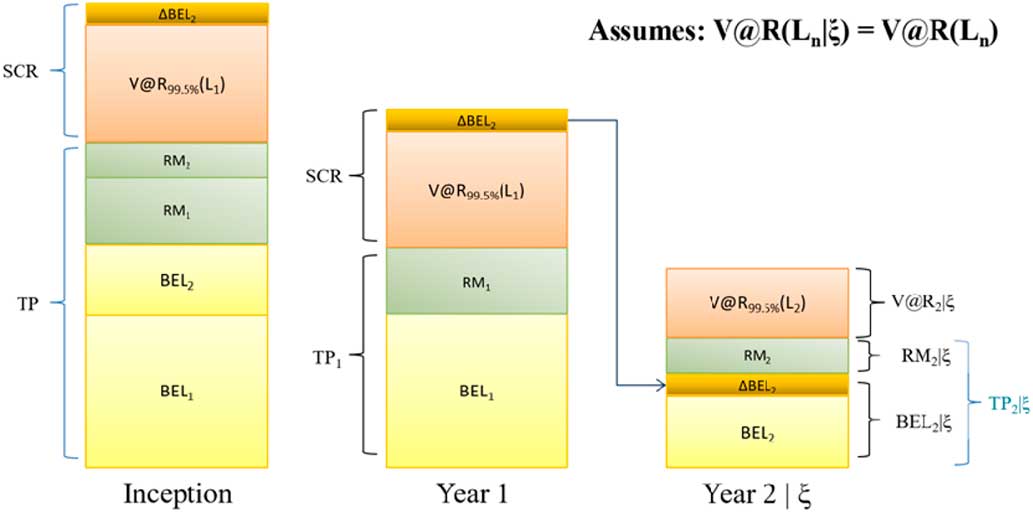

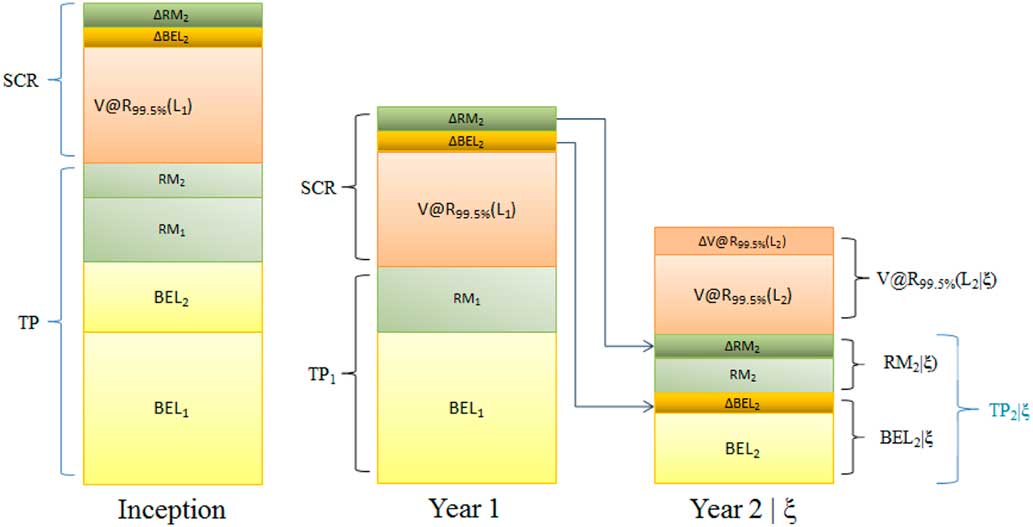

Solvency capital requirement and the claims development result | British Actuarial Journal | Cambridge Core

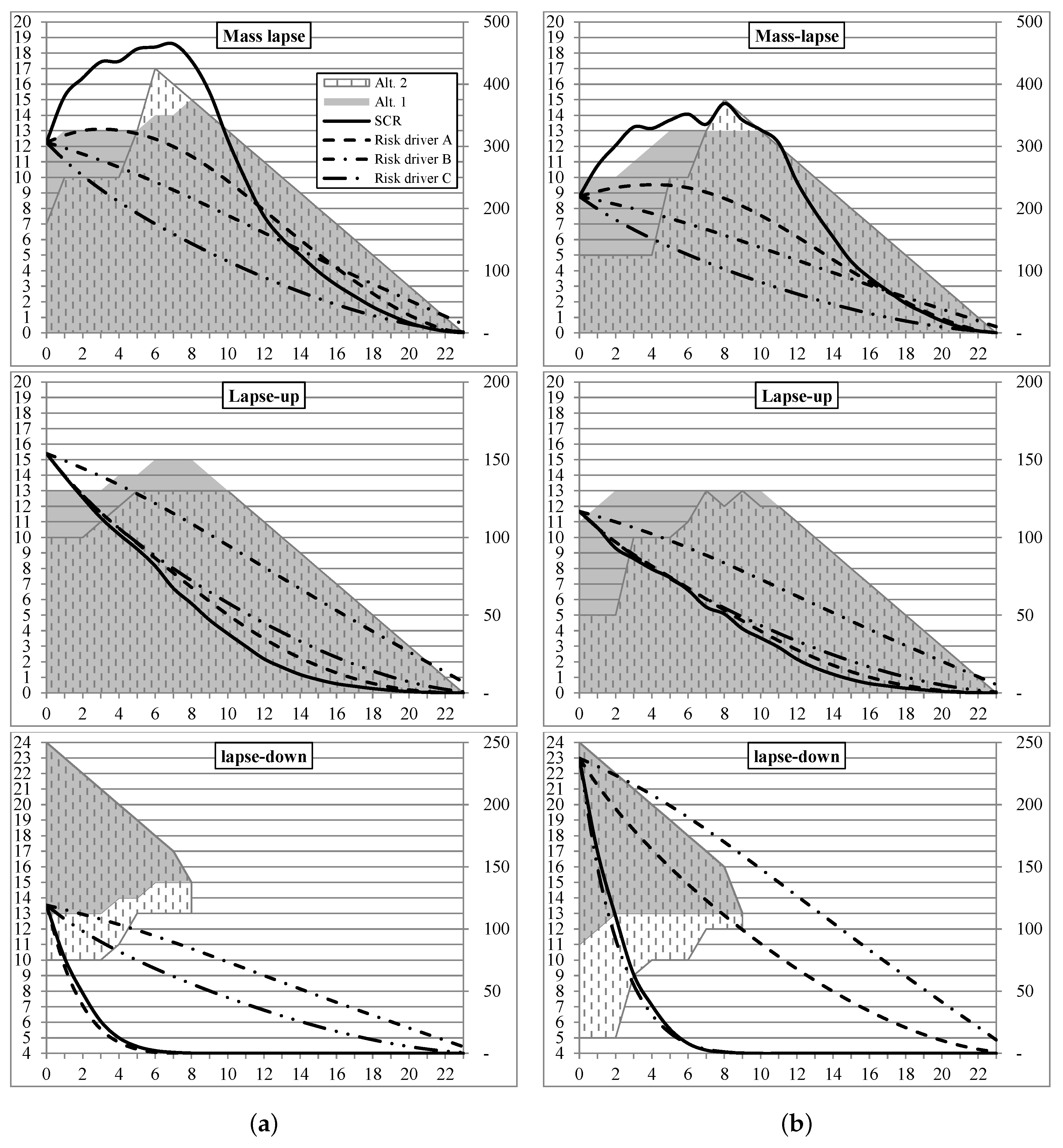

Risks | Free Full-Text | Surrender Risk in the Context of the Quantitative Assessment of Participating Life Insurance Contracts under Solvency II